By Steve Toloken

STAFF REPORTER / ASIA BUREAU CHIEF

Published: July 22, 2014 12:39 pm ET

Updated: July 22, 2014 12:43 pm ET

Image By: Rich Williams

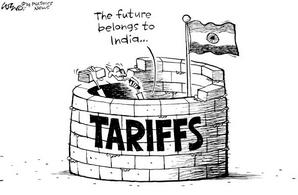

What’s the best way for an emerging economy to strengthen an under-developed plastics industry? Protective tariffs around key sectors, or open the gates to global competition?

India’s plastics industry seems determined to try the first approach.

As we reported recently, the country’s main trade group for plastics machinery wants new anti-dumping duties on competitors from around Asia.

In 2009, India put very high duties (60 to 174 percent) on many grades of injection machines from China. Now, the New Delhi-based Plastic Machine Manufacturers Association of India wants those tariffs extended to Taiwan, Vietnam, the Philippines and possibly elsewhere.

It argues that it needs tariffs on those competitors to protect it from a flood of low-priced foreign competition. Those imported machines “are at dumped prices and causing injury to the Indian domestic industry,” PMMAI said.

But anything that protects the domestic molding machine makers will hurt their customers, injection molders. It will raise prices, reduce choices or lengthen delivery times for molding companies, making them less competitive globally.

For those reasons, some leaders in the processing sector oppose new tariffs, including Raju Desai, director of injection molder Jyoti Plastic Works Pvt Ltd. in Mumbai and chairman of the Plastivision 2013 show.

When I was at Plastivision in Mumbai in December, there was a lot of talk among Indian companies about the need for more protection from imports in general.

One trade group, the All India Plastics Manufacturers’ Association, used public forums at the show to repeatedly push for 20 percent tariffs to help plastic molders against imported plastic products from ASEAN countries and China.

Some Indian resin manufacturers were celebrating their own tariff increases on imported plastic resin.

As one Indian resin company put it in its annual report, higher tariffs on imported plastic were a “welcome development” that are “expected to sustain net margins for producers.”

Sure, that’s true. But it’s also true that higher tariffs would hurt the net margins for Indian processors.

Whenever I travel in India, I always hear a lot of talk about how the future belongs to the country, with projections of big growth and the demographic advantages of a young population, in contrast with East Asian countries like China, which face a rapidly aging population.

But with their calls for more tariffs, are India’s industries lacking in confidence?

The tariff push seems to contradict their message that the future belongs to India. Over the long term, creating more walls doesn’t seem the way to build a globally competitive industry.

A lot of people compare China and India. They each have basically the same population, but China’s plastic industry is five times larger.

Chinese companies argue they’re more competitive because they’re larger, not because they’re dumping their machines in India at unfair prices.

Now, as the tariffs on Chinese equipment have worked as India’s government intended and shut those companies out of India, Indian companies are trying to take it a step further and make the case that many places — not just China — are dumping machines there.

Of course, every country like India tries to protect its industries.

China is arguing that it’s the victim here in this machinery dispute, but the Chinese government puts its own restrictions on foreign investment, such as requiring foreign companies to partner with local companies in sectors like cars and petrochemicals.

India’s economy has slowed down the last few years, the bloom has come off the rose of “Incredible India” as far as the economy is concerned, and that could be driving a lot of the tariff talk.

But since tariffs are never a zero-sum game — protecting one sector like machinery will inevitably hurt others, like processors — it seems like India’s government and plastics industry need to sit down and put together a more cohesive strategy for development. |